Recent frosts across the Mid North have resulted in thousands of hectares being cut for hay in an effort to salvage a return from what was surprisingly good potential crops.

Vast tracts of wheat have been mown down in the last ten days, while other crops to come under the mower have been barley, peas, lentils and canola.

A frost event is devastating and, in many cases, has reduced yield potential by 50-100 per cent. Cutting a crop for hay is an opportunity to gain some return.

Sadly, there are a lot of lentil crops this year that simply have not produced enough bulk for hay. Growers will have to hope for a rain event to get some sort of return.

Pinery lentil grower Kelvin Tiller is no stranger to lentil hay and was windrowing his frosted lentils last week. Lentils make excellent hay, but this year the bulk is not there and by windrowing his lentils Kelvin can create a 72ft swathe.

This means he may not need to rake it, thus saving a lot of the leaf often lost in this process. Anything with a string around it this year will make a market, as we march through one of the driest seasons on record.

The Grain Market

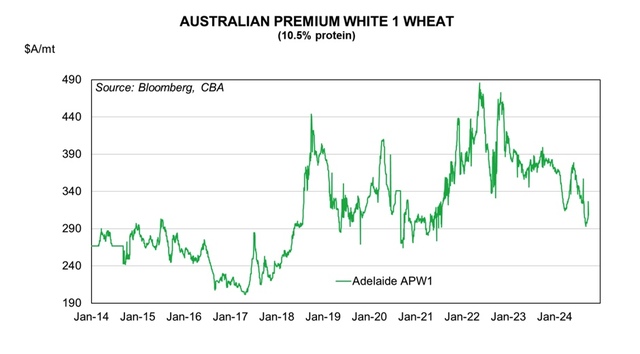

I caught up with Dennis Voznesenski, Agricultural Economist with the CBA, last week and asked him what’s in store for South Australia’s grain market with harvest rapidly approaching.

Is SA in a very dry bubble market-wise and are we dreaming if we expect high prices in a record drought?

“The SA market can only disconnect from the east coast to a limited extent. SA prices should follow what happens on the east coast. If the current dry conditions across the east coast worsen and crop yield potential is stunted, it would support prices on both the east coast and in SA.”

Are you bullish or bearish price-wise. Where do you see the market heading in two months?

“Recently we have seen a drying pattern over not just SA, but most of the east coast. The drying conditions are supportive of prices. At the moment APW1 and feed barley track markets are below our forecast range, meaning there could be some support as we head into 2025. Global markets are already on an upward trend, with dryness in the Black Sea during winter wheat planting and dryness in Argentina supporting markets. Total ending stocks in key exports markets are expected to decline in 2024/25.”

Are there other options for low quality grain?

“BOM is forecasting a high chance of exceeding median rainfall between October and December. Significant rains during harvest could increase the feed wheat availability and cause feed wheat to trade at a sizeable discount to APW1.”

What sort of decile are we at price-wise, at the moment?

“Using the last 10 years of data for APW1 track Adelaide, the current price of $308/mt is in the 40 th percentile.”

Will the wet season on the eastern seaboard impact South Australian grain markets?

“Yes it will, but for now it’s getting drier.”

So basically, it’s not all doom and gloom but we can assume grain prices will be firm but not at the usual levels associated with drought conditions. Ed.

Richard Fabry takes out 2023 Allan Tiller Memorial Wheat Trophy

Long Plains grain grower Richard Fabry has taken out this year’s prestigious Allan Tiller Memorial Wheat Trophy. Richard and Cliff Fabry’s crop of Calibre wheat is located between Long Plains and Mallala.

Judges were impressed with the spotless fence lines and gateway with not a weed in sight. After walking into the crop for some distance and still being unable to find a weed, they eventually gave up looking.

Points were also awarded for the even look of the wheat, which looked healthy with heads filling nicely. Overall, a very impressive wheat crop.

Runners up were Wayne and Jack Heaslip with a handy crop of Calibre wheat. Slippy’s blatant attempt at bribery by supplying the judges with an esky full of beer and lollies very nearly got him over the line. Another impressive crop of wheat.

Balaklava Show delivers the goods

Traditionally the Balaklava Show Day is the tipping point for growers across the Mid North. It is either a howling north wind or cold and wet.

Farmers often say we still have to get past the Balak Show Day when looking at long-range forecasts. This year it was 26 degrees and yep, a howling northerly.

Fortunately, that wind finally blew in some much-needed rain after a six-week dry spell. Most crops that have hung on this long will benefit from Saturday night’s rain band, ensuring grain fill and stem elongation.

Sadly, those crops on heavy ground that have not made it this far are still buggered, and frosted crops will still not produce. Any hay on the ground should be okay as it was not a major rain event and the ground beneath the rows is very dry.

Where the rain fell

Matt Vogt (Hamilton) – 7mm

Kelvin Tiller (Grace Plains) – 8mm

Brian Parker (Owen) – 12mm

Glen Bubner (Alma) – 12mm

Pat Redden (Clare) – 6.5mm

Wayne Davis (Jamestown) – 2.5mm

Ben Mudge (Inkerman) – 6 mm

Trevor Cliff (Kimba) – 6 mm

Andy Michael (Upper Wakefield) – 10mm

Wayne Molineux (Tarlee) – 7mm

Richard Konzag (Mallala) – 11mm

Jim Franks (Mallala) – 13mm

Derek Tiller (Pinery) – 8mm

Trevor Day (Kapunda) – 6mm

Rob Saint (Erith) – 9mm

Balaklava High School – 11mm

Bryce Chapman (Redpath Corner) – 11mm

Wayne Heaslip (Grace Plains) – 8.5mm

Auburn Mesonet – 12.6mm

Hart Mesonet – 6.0mm

Nantawarra Mesonet – 4mm

Bowmans Mesonet – 6mm

Mintaro Mesonet – 6mm

Saddleworth Mesonet – 5mm

Steve Schiller (Tanunda) – 13mm

Andrew Plueckhahn (Manoora) – 7.5mm

Gaye Kuerschner (Black Rock) – 1.5mm

Darren Schilling (Bute) – 8.5mm

David Miller (Saddleworth) – 8mm

Ben Wundercitz (Maitland) – 6mm

Mark Parish (Auburn) – 10mm

Viterra acquire GrainFlow sites in SA and Victoria

Viterra has entered into an agreement with Cargill to purchase their GrainFlow sites in Mallala, Maitland, Crystal Brook, Pinnaroo and Dimboola.

Viterra believes that this will create efficiencies for the South Australian and western Victorian supply chain.

Growers can expect a 15 per cent reduction in freight rates out of the South Australian sites, according to Viterra chief executive officer Philip Hughes.

He also stated that they will be investing about $25 million into these sites in the first two years and a further $8 million annually to support efficient outturns.

Cargill and Viterra/Bunge/Glencore are the largest international grain buyers in Australia.