This week’s Over the Fence comes directly from Iceland where I have been examining the condition of Icelandic livestock, mainly sheep, which have recently lambed (twins are common).

The rules around agistment here appear much different than at home. Sheep are allowed to graze on roadsides but seem completely uninterested in the fact that it might be a major highway, happy to sit on the edge and watch the cars fly by.

One landowner, who owned about 2500 hectares of mostly mountainous country, said his neighbour grazed his country for free as he no longer ran stock.

Come autumn, he is expected to also organise mustering, mostly by foot. This amazed me, as do Icelandic sheep who graze alongside waterfalls and in the mountainous country.

Iceland’s national dish is supposedly hákarl or fermented (rotten) shark, but I guarantee it is lamb soup, as it is sold everywhere from food trailers to restaurants and even in a tin at the supermarket. Icelandic woollen jumpers retail for around $550 Australian so, no, I did not buy one.

There is a lot of hay produced, all of it silage, wrapped in round rolls to tide the stock over their brutal winters. Aside from that, this country is magnificent with waterfalls and glaciers in abundance.

It is either vast volcanic wasteland or grass as far as you can see, a land of contrasts.

Centre State Exports Market Update

Last week Paul Lange of Centre State Exports provided me with some interesting insight into the current state of play regarding the world grain

markets. Volatility is the key take home message with the escalation in the Middle East. Hopefully calmer heads will prevail, and the market will settle over coming months.

Most of the winter crops are now in the ground across southern Australia, and finally a tinge of green is starting to appear after a long dry spell.

Patchy rain fell across SA in the past 10 days with the isolated coastal areas getting more than 30mm while some inland and further north receiving less than 10mm.

It has not been a drought breaker by any stretch, but the change in weather patterns has been promising with consistent fronts rolling through and some more on the forecast ahead.

Local markets, while still running at a premium to global prices, lack engagement from growers, as the price is not rewarding enough in contrast to the production risks this early in the season.

Global markets have been on a roller coaster in the past few weeks. The major factors include the rise in the Middle East conflict, geopolitical clashes with tariffs and wars, while continuing to focus on the Black Sea, US and Europe crop conditions.

GEOPOLITICS

Last week, Israel and Iran tensions escalated with drone and missile strikes exchanged over several days causing injury and death to hundreds of people, including civilians.

This is a war that is teetering on the edge, with President Trump having to step in and use his influence to diffuse assassination and potential nuclear plans from both sides.

When Trump was asked if the US would strike an Iranian nuclear site, he said, “I may do it. I may not do it.” This conflict is likely to increase shipping costs and may threaten usual trade flows through the region, including the Suez Canal, which is critical to global shipping.

The largest threat is to crude oil, with an estimated 30 per cent of the World’s oil trade flow stemming from this region. Any disruptions will impact oil markets globally which in turn would support oilseed prices.

In conjunction with the conflict, this week the US EPA announced that they have increased blending targets by 67 per cent for biofuels next year. On the back of this, local markets have risen $15-20 for old and new crop canola.

The late break has meant less canola has been planted in favour of heartier and more reliable cereals. The extent to which area has been pulled back is hard to attain at this stage but could be a factor later this year to local canola pricing.

WHEAT CONDITIONS AND PRODUCTION

Even with the world’s current uncertainty with conflicts and tariff situations out of the US, the wheat market had remained subdued until Thursday morning’s 25c/bushel rally.

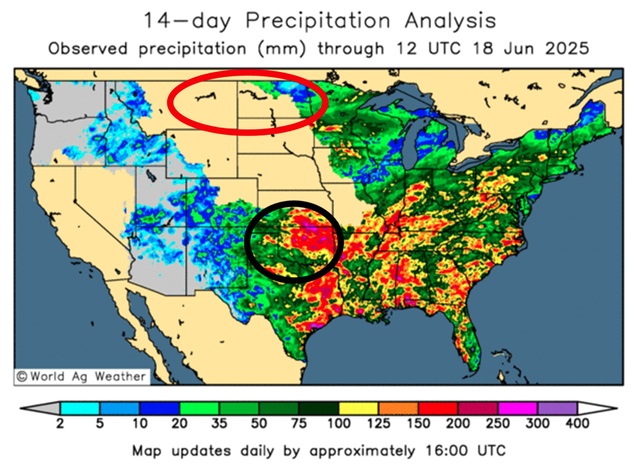

Concerns around some crop quality in the US and Russia has also flowed onto the market. The northern hemisphere harvest has started, there are strong early yields reported out of parts of the US northwest, but there are some areas in the southern plains, such as Oklahoma, that have been hit by excessive rain which will most likely diminish quality.

Adding to concern is a hot dry spell that is running through crucial spring wheat areas to the north during key growth stages. Moving into Europe, there is beneficial rain falling in areas that had suffered through some dry spells, which is a positive on their production front.

In the Black Sea, hot and dry conditions are forecast in the next seven days with some areas suffering to the point that a drought emergency has been declared.

Wheat stocks globally, are at the lowest point since 2021/22, currently the market seems unaffected. The increases in global production as slated by the most recent USDA report is keeping a lid on price spikes.

Unless there is a major hiccup in production, it is expected to stay that way over the next couple of months as substantial new crop wheat hits the market.

PULSES

Faba bean production in the most recent ABARE report has seen a reduction on last year’s crop from 750kmt to 680kmt on very similar hectares planted.

Northern areas of NSW and into Queensland received good early establishment being able to plant into moisture and have had follow up rains. Conversely, southern NSW, Victoria and SA have been patchy and confidence in this season’s crop is low this far out.

Old crop beans are all but tidied up from the grower front but there is stock yet to be exported. With Egypt still the main player for this coming season, they are currently trying to work through their stock on hand and what is still to arrive.

This may lead to subdued early season demand and softer pricing come harvest time. Lentil area, and therefore production, is expected to fall this coming season according to ABARE with close to 100,000 hectares and 170kmt taken off last year’s totals.

The late start has impacted these numbers, but the lentils are now starting to poke their heads out of the ground across SA and Victoria with the recent opening rains.

Demand for new crop lentils is fairly limited this time of year until August/September whilst the trade into the sub-continent wait to see how both the Aussie and Canadian crop progress.